Why the US Federal Reserve should stop increasing interest rates

Introduction

In its May 2023 monetary policy meeting, the US Federal Reserve raised interest rates by 0.25 percentage points. With this interest rate hike, the benchmark rate has reached its highest level in 16 years, rising from near zero in March 2022 to 5.25% in May 2023. Now the US Federal Reserve should stop increasing interest rates as it is having more negative effect on American economy which will be analyzed in this article.

Why the US Federal Reserve should stop increasing interest rates

America still has inflation that is more than three times the national average. The greatest annual inflation rate in the United States since the Consumer Price Index (CPI) was created in 1913 was 17.8% in 1917. The consumer prices increased up to 9.1% for the year that ended in June 2022. The biggest rise in consumer prices in the past 40 years can be found in the CPI. The US Federal Reserve started raising interest rates to reduce the country's extremely high inflation. The US Federal Reserve, however, ought to have ignored these economic statistics (inflation and producer prices relationship and their correlativity).

|

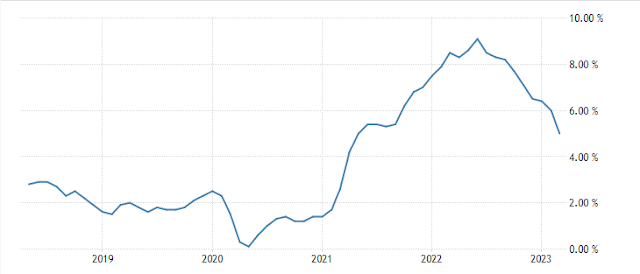

| Figure 1 Showing a line chart of year wise inflation rate in America. |

Figure 1 is a line chart of inflation rate with year in America. After 2022 the inflation is in decreasing mode.

|

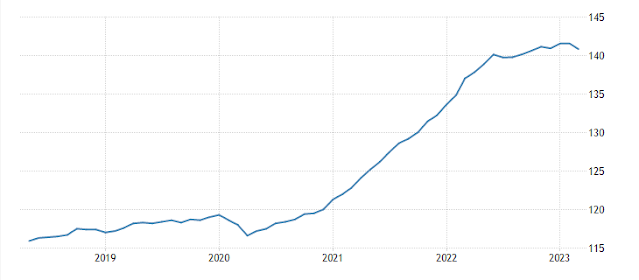

| Figure 2 having line chart showing producer prices in the United States from 2019. |

Whereas producers prices (Figure 2) are also showing slow momentum in price rises. Figure 2 having line chart showing producer prices in the United States from 2019. Line chart clearly shows that after initial months of 2020 the producer prices have started to increase drastically and steadily. This price rise is even higher than the pre-Covid time.

These data suggest that the present inflation management is the more responsibility of the Federal Government as present high inflation is not due to excess credit liquidity in the economy. Present inflation is due to higher producer’s prices and services which require intervention of the Federal Government.

Negative impact of rising interest rates in American economy

1. Impact on industrial growth

Figure 3. A line chart showing the GDP growth rate with year.

Removing sharp and big fall and rise anomalies of GDP in quarter Q2 and Q3 2020, growth is in slowing phase (Figure 3). The GDP growth in 2022 is relatively lower than 2021. Before Covid-19 also growth in American economy was more or less stagnant. With interest rate rise new projects will be hampered due to higher cost of loan. So companies will stop new investments in new projects due to higher risks of slowdown.

2. Impact on job growth and employment

Due to higher burrowing cost companies will prefer to pause new projects and consumer demand is not very robust and so new projects with higher interest capital may be more risky for the businesses. This will slow down employment generation in newer projects.

3. Impact on small and medium business enterprises

Micro, small and medium enterprises (MSME) will face more difficulty due to higher interest rates. MSME has relatively smaller market size and do not have cash surpluses so faces financial problems in running their businesses. But MSMEs are equally important in boosting countries growth with employment generation at their own level.

4. Impact on Federal Government’s financials

America is already under huge debt amounting to more than $31 trillion. At present about 12% of the total federal government spending goes to servicing debt. Higher interest rates will increase debt of the America as the Federal Government will have to borrow money from the market at relatively higher interest rates.

5. Impact on low income citizens

Low income citizens and their families will face more financial hardship as they will have to pay more interest rates on loans. So they may cut their expenditures which will have further negative impact on growth in America. The USDA estimated that 11.1% of US households were food insecure in 2018. This means that approximately 14.3 million households had difficulty providing enough food for all their members due to a lack of resources. This data is pre-Covid pandemic. During the Covid-19 period more households became food insecure due to lockdown, closure of companies, layoffs, etc. Higher interest rates will exclude such population from the community of loan takers.

Positive impact of rising interest rates in American economy

1. Impact on cash rich peoples and cash rich companies

Overall higher interest rates regime benefits mainly those who have ample cash. Those peoples who have cash can get higher returns on depositing their cash in fixed deposits, government bonds, etc. Similarly cash rich companies utilize this opportunity to strengthen their market shares which are created by the closure of micro, small and medium enterprises.

Conclusions

The US Federal Reserve should halt rising interest rates, according to the explanation above. The federal government has a greater responsibility for managing the current inflation as the current high inflation is not the result of an excess of credit liquidity in the economy. The current inflation is a result of rising producer prices and services that necessitate federal government action. Higher interest rates benefit proportionately fewer people and exclude a greater number of people from the financial services utility regime, whereas low interest rates increase the number of persons who have access to financial services. Due to greater loan interest payments, higher interest rates also have a negative effect on the federal government's balance sheet.

Comments

Post a Comment