How US Federal Reserve's monetary policy is pushing more Americans into poverty and income inequality.

Introduction

The US Federal Reserve is, at present, shouldering the task of inflation management through its monetary policy. From the early months of 2022 interest rates are increasing from below 1% to 4.75%. America is facing the huge challenge of high inflation. The inflation rate over year was 6.4% in January 2023. Inflation is still more than three times the national average. Since the introduction of the Consumer Price Index in 1913, the highest annual inflation rate in the U.S. was 17.8% in 1917. Over the year ended June 2022 consumer prices reached up to 9.1%. This CPI is the most significant increase in consumer prices in 40 years. Federal Reserve has said they will continue to increase interest rates. However the Fed’s handling of inflation management through interest rate hike is not appropriate. Many socioeconomic and industrial parameters (Personal income, Consumer spending, Household saving rate, Personal spending, Industrial production, and Producer prices) were evaluated which indicates that the Fed’s hike interest rate based policy is damaging US economy and pushing more Americans into poverty and income inequality. Investigated socio-economic and industrial parameters results are provided here.

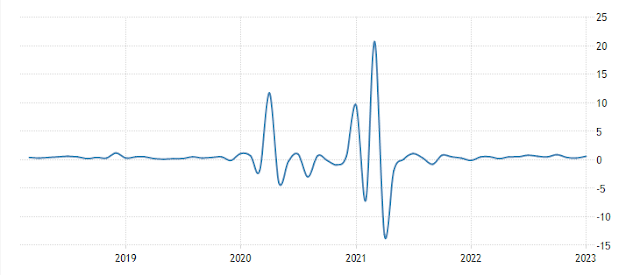

Personal income analysis

Figure 1 shows a line chart of personal income growth with year. In January 2023, personal income in the United States increased by 0.6 percent from the previous month, picking up from a downwardly revised December rise of 0.3 percent. In line chart few upwards and downwards anomalies are of Covid-19 pandemic period which surfaced during last months of 2019. The higher personal income growth peaks during pandemic was due to financial support from the Federal Government. Removing those anomalies from line chart clearly indicates that personal income growths of Americans are more or less stagnant.

|

Figure 1. A line chart showing pre and post Covid 19 personal income growth of American peoples. |

Consumer spending analysis

|

|

Figure 2. A line chart showing pre and post Covid 19 consumer spending growth of American peoples. |

Household saving rate analysis

Household saving rate in the United States increased to 4.70 percent in January from 4.50 percent in December of 2022 (Figure 3). Figure 3 having line chart clearly indicates that household savings of American peoples are relatively lower in comparison to pre-2019 period, except anomalous Covid-19 period during which American peoples received monetary support in cash by American government.

|

|

Figure 3. A line chart showing pre and post Covid-19 household saving rate growth of American peoples. |

Personal spending analysis

Figure 4 having line chart indicates that personal spending in the US jumped 1.8% month-over-month in January of 2023, rebounding from a downwardly revised 0.1% drop in December. A pre and post Covid-19 comparison in line chart does not show much difference, except short anomalous period in which personal spending decreased and increased drastically for a short time period.

|

|

Figure 4. A line chart showing pre and post Covid-19 personal spending growth of American peoples. |

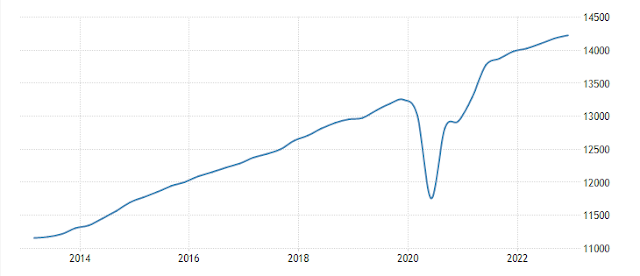

Industrial production analysis

Figure 5 shows the industrial production growth in the United States which increased in small amount 0.8% year-on-year in January of 2023, the smallest increase since the pandemic recovery started in March of 2021. Figure 5 shows that industrial production growth is relatively stagnant in comparison to 2019 period except short anomalous period of Covid-19. After peak in 2021 the industrial production is on declining path (Figure 5).

|

|

Figure 5. A line chart showing pre and post Covid-19 industrial production growth in America. |

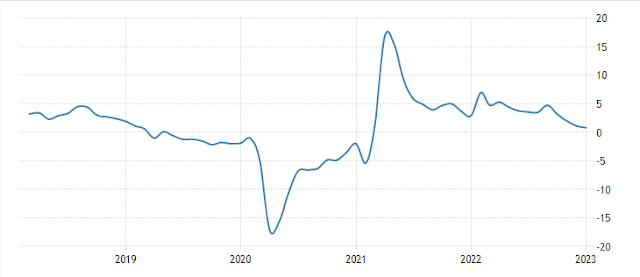

Producer prices analysis

Figure 6 having line chart showing producer prices in the United States from 2019. Line chart clearly shows that after initial months of 2020 the producer prices have started to increase drastically and steadily. This price rise is even higher than the pre-Covid time.

|

|

Figure 6. A line chart showing pre and post Covid-19 producer prices growth in America. |

Conclusions

Evaluation of many socioeconomic

and industrial parameters (Personal income, Consumer spending, Household saving

rate, Personal spending, Industrial production, and Producer prices) indicates

are the present inflation in America is due to rise in producer prices but not

due to excess consumer spending. One important aspect in data evaluation

reveals that the increased consumer spending follows more closely the increase

in producer prices as personal income, industrial production, personal spending

are relatively stagnant whereas household saving rate is decreasing. The

decreased household saving rate, with stagnant personal income growth,

indicates are more American peoples are becoming economically stressed leading

to poverty and income inequality. The Federal Reserve and the Federal Government should sit together to evaluate that why in year 2000 (with GDP of about 10 trillion dollar) about 17 million peoples were on Food Stamp/SNAP (food subsidy) which increases to about 38 million in 2019 (with GDP of about 21 trillion dollars). This clearly shows, even with increase and doubling of GDP and debt of about 27 trillion dollar, more American citizens facing economic hardship with time. Recent collapse of Silicon Valley Bank (SVB),

Silvergate Bank and Signature Bank in America further increase the poverty and

income inequality as many small to medium business will be closed down and

their employees will be layoffs. So the Fed and Federal Government both's policies are not correct and require correction.

This study reveals that

the present inflation in America is due to increase of producer prices which

are forcing consumer spending eventhough household saving are decreasing and

personal income growths are stagnant. That’s why the US Federal Reserve is

unable to control inflation. So the Federal Reserve should avoid using hike

interest rate as a tool to control inflation. Instead the Federal Government

should work with the industry to lower producer prices through policy-program implementation and demand-supply

equilibrium management.

Very nice article. The US Fed and Federal government should follow it.

ReplyDeleteFed is unable to understand that the present inflation in America is due to increase of prices by producers so the Federal government have more role to play in inflation management.

ReplyDeleteGood insights with data.

ReplyDelete